Sample Financial Plan

The Plan

A Personal Financial Plan should help you determine if you are getting the best life possible with the money you have.

It should be a plan to help you enjoy the fruits of your hard work, to confidently face life’s challenges, and to leave a legacy to the people and causes that mean the most to you.

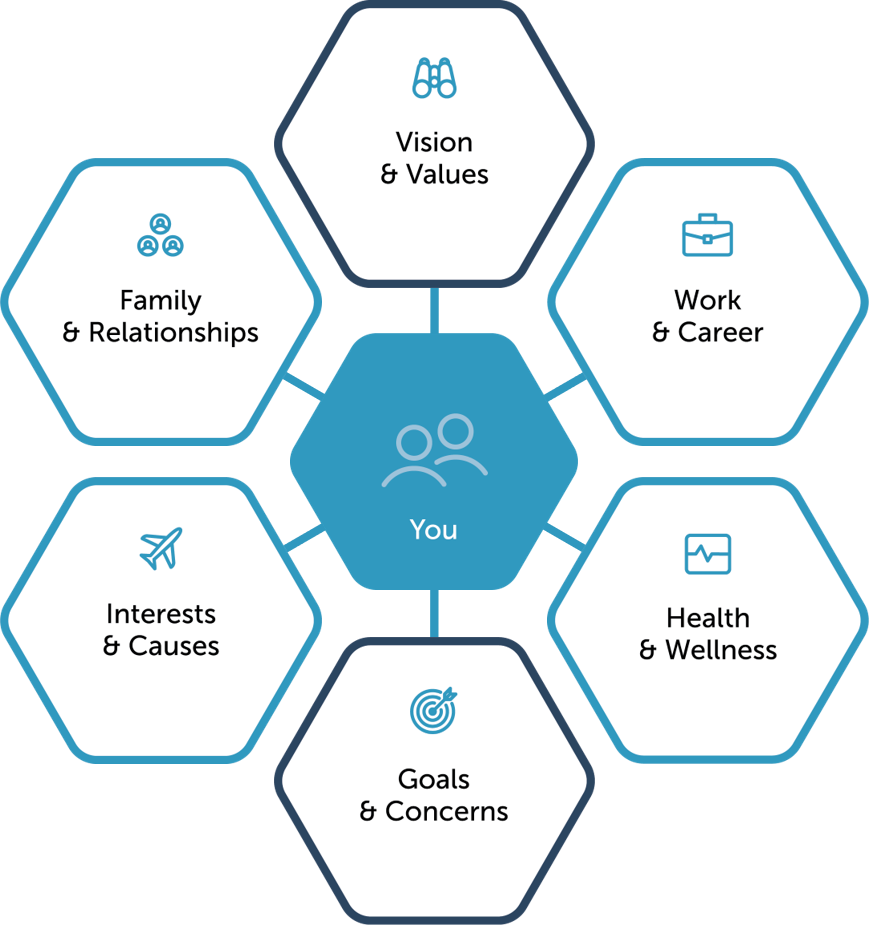

Our Process

We place your unique personal values, goals, motivations, and priorities at the center of the planning process. Our process begins with a conversation about what is most important to you to ensure that the financial recommendations we make are supporting that.

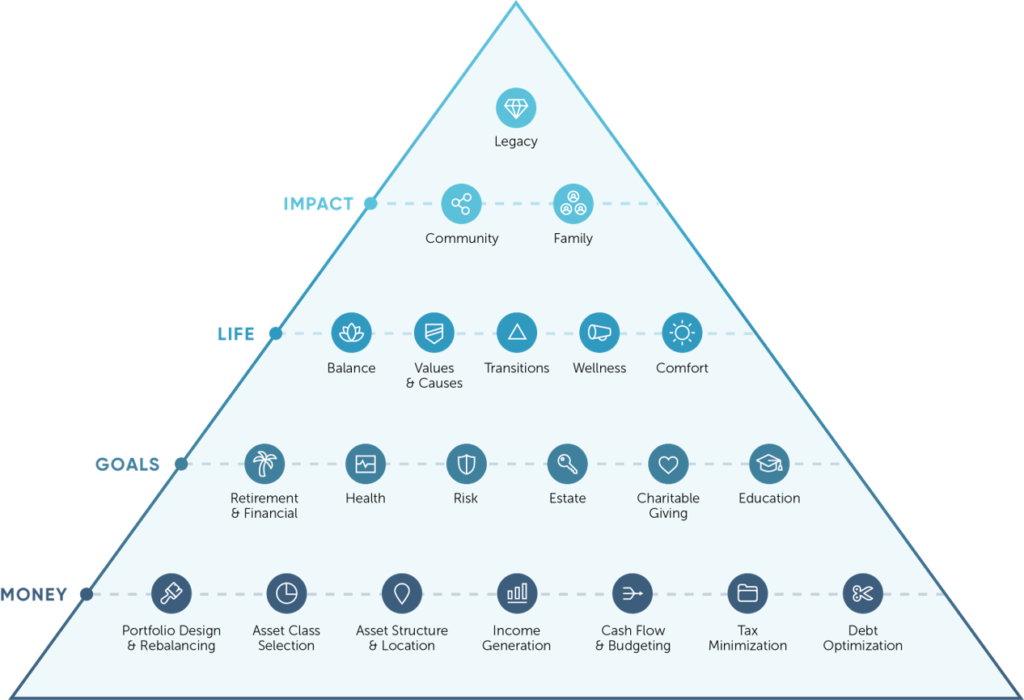

The Planning Pyramid

Think of planning as a pyramid. While money is at the base of all financial planning, our process helps you set financial goals, life goals and think about your impact on your family and community.

This process can help you examine and understand the trade-offs that any financial plan presents so you can achieve the best life possible with the money you have.

Are you getting the best life possible with

the money you have?

Sample Plan

We have developed a hypothetical financial plan. The people and circumstances are completely fictional and are for illustrative purposes only and it is possible that your unique plan will not address all that is illustrated here. It is provided to give an example of the types of items we feel should be covered in financial planning.

In our sample plan, Jane & John Jones are 60 years old and employed. They would like to retire at age 65 and plan for a thirty-year retirement. They have two children (James, age 16, and Janet, age 14) and would like to fully fund college for both.

We would help Jane and John clarify their goals and prioritize them into Needs, Wants and Wishes.

Because no one knows what future returns will be, we would then use Monte Carlo analysis to show the likelihood that Jane and John will meet their goals. Monte Carlo analysis is most useful as a big picture illustration of the probability of success of a plan.

We would then present our results in an easier to understand Summary Report that is usually two to four pages and a detailed Wealth Analysis Report that can run up to 30 pages or more.

Our Values

Our planning process is based on the following core values:

- Organization – We help bring structure to your financial life.

- Accountability – We help you stay on track and follow through.

- Objectivity – We provide insight without bias.

- Insight – We help you anticipate key transitions in your life.

- Education – We help provide the knowledge you and your family need to succeed.

- Partnership – We help you achieve your best life possible.

Personal finance is more personal

than finance.